UK HMRS VAT652 2009-2024 free printable template

Show details

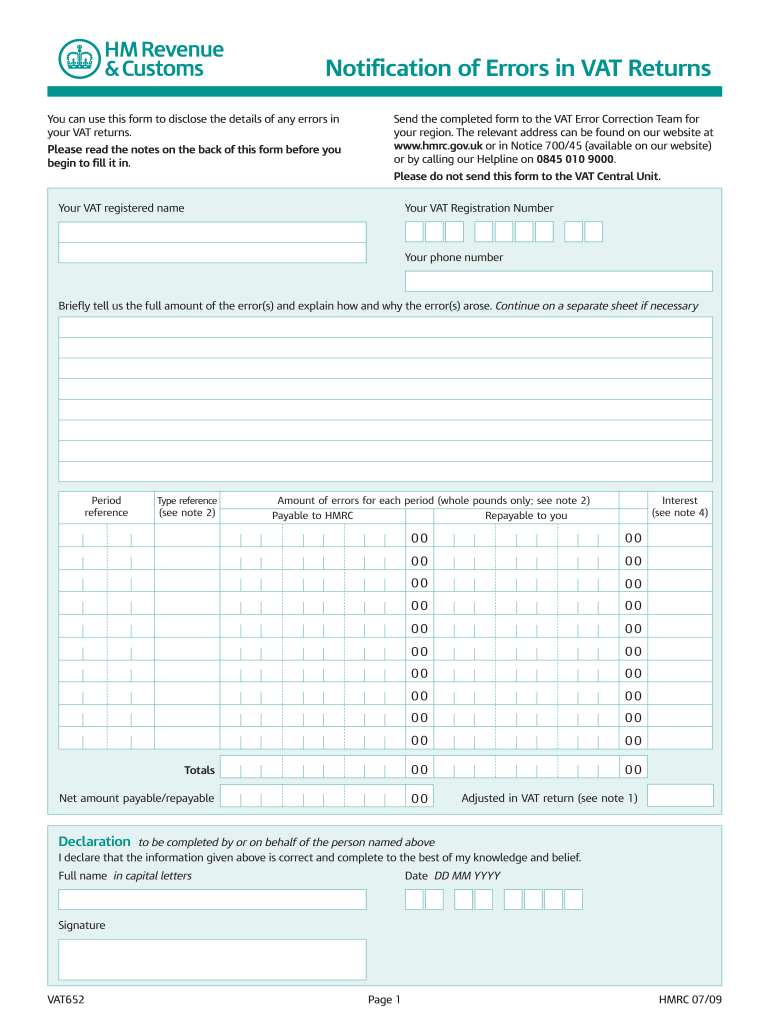

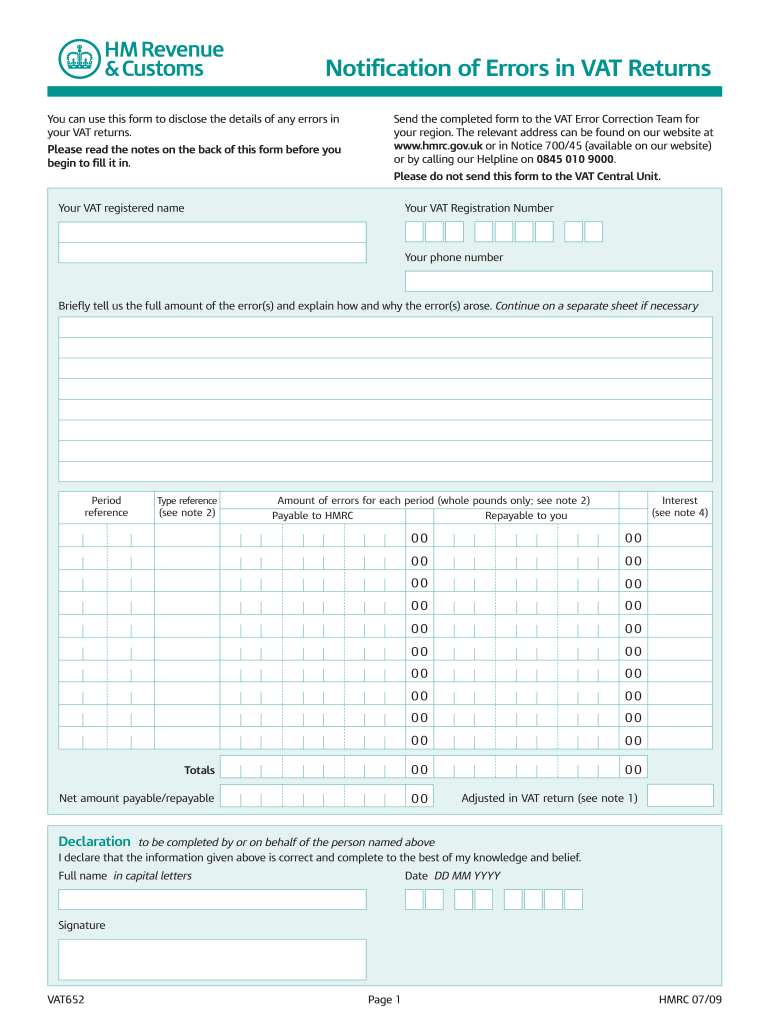

Notification of Errors in VAT Returns You can use this form to disclose the details of any errors in your VAT returns. Send the completed form to the VAT Error Correction Team for your region. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat652 form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat652 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat652 form pdf online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vat 652 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out vat652 form pdf

How to fill out VAT652:

01

Fill in your personal details such as name, address, and contact information.

02

Provide your VAT registration number, if applicable.

03

Indicate the period for which you are filing the VAT return.

04

Calculate your total output tax, which represents the VAT you have charged on your sales.

05

Determine your total input tax, which represents the VAT you have paid on your purchases.

06

Calculate the difference between your total output tax and total input tax to find the net amount of VAT due or reclaimable.

07

Fill in any adjustments or corrections that need to be made to your VAT return.

08

Sign and date the VAT652 form before submitting it to the appropriate tax authority.

Who needs VAT652:

01

Businesses that are registered for VAT in the respective country.

02

Individuals or entities that are required to submit regular VAT returns.

03

Any taxpayer who has made taxable sales and purchases during the relevant period and needs to account for VAT liabilities or claim VAT refunds.

Fill vat 652 pdf : Try Risk Free

What is vat652 form?

Use form VAT652 to tell HM Revenue and Customs of any errors that you have made on your previous VAT returns that are over the current error reporting threshold.

People Also Ask about vat652 form pdf

Why do we pay VAT?

What is a VAT 652 form?

What is the VAT adjustment and why is it charged?

How long does it take to process VAT 652?

What is VAT 652?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file vat652?

Businesses registered for Value-Added Tax (VAT) in the UK must file a VAT Return (VAT652) with HM Revenue and Customs (HMRC) at least once every three months. This includes businesses that are registered for partial exemption, those that are registered for distance selling, and those that are part of a VAT group.

When is the deadline to file vat652 in 2023?

The deadline to file a VAT652 in 2023 is 31st January 2023.

What is the penalty for the late filing of vat652?

The penalty for late filing of a VAT 652 form in the UK is a flat fee of £100.

What is vat652?

VAT652 refers to a form issued by the HM Revenue and Customs (HMRC) in the United Kingdom. This form is used for claiming repayment of VAT for government departments, their executive agencies, and certain non-departmental public bodies. The VAT652 form allows these organizations to reclaim VAT on eligible purchases and expenses.

How to fill out vat652?

To fill out form VAT652, you need to follow these steps:

1. Start by providing your business details in section 1. This includes your VAT registration number, trading name, and address.

2. In section 2, you need to input the period for which you are submitting the form. This can be a single month or a quarter, depending on your reporting period.

3. If you are appointing an agent to act on your behalf, fill out section 3 with their details. Otherwise, you can leave this section blank.

4. In section 4, you need to enter the total value of taxable supplies you made, excluding VAT. These supplies include both standard-rated and reduced-rated supplies.

5. Proceed to section 5, where you'll provide details of any exempt supplies you made during the period.

6. In section 6, enter the total value of supplies that were used or sold within the EU, excluding VAT. This applies to both goods and services.

7. Next, in section 7, you should provide the total value of acquisitions made from other EU member states, excluding VAT.

8. In section 8, you need to indicate the total value of any goods acquired from EU member states, excluding VAT.

9. If you have made any zero-rated or reduced-rated acquisitions, they should be entered in section 9.

10. In section 10, you'll provide details of any purchases made for which you claimed and were entitled to a refund under the VAT Retail Export Scheme.

11. Section 11 is for those who are reclaiming VAT on overhead costs. Here, you should input the amount of VAT to be reclaimed.

12. In the final section, sign and date the form. If you are submitting this electronically, an electronic signature will be sufficient.

Remember to keep a copy of the completed form for your records.

Note: It is advisable to consult with a tax professional or review the official guidance provided by your country's tax authority specific to VAT652 and your jurisdiction to ensure accuracy and compliance.

What is the purpose of vat652?

VAT652 is a tax form used in the United Kingdom for Making Tax Digital (MTD) for VAT purposes. It is used to make a claim for input tax or make an adjustment or correction to previously claimed input tax. The purpose of the form is to ensure accurate reporting and calculation of VAT liabilities and to claim back any eligible VAT credits.

What information must be reported on vat652?

The VAT652 form is used by UK businesses to report adjustments made to VAT returns. The specific information that must be reported on this form includes:

1. The VAT registration number and name of the business.

2. The period covered by the VAT return in question.

3. The date and amount of any over-declaration or under-declaration of VAT on previous returns.

4. The reason for the adjustment, such as a revised value of supplies, corrections to errors, or changes to the VAT liability.

5. The net value and amount of VAT due or repayable for each adjustment.

6. Any related input tax in relation to the adjustment.

7. The total VAT due or repayable for the period after the adjustments have been made.

It's important for businesses to ensure that the information reported on VAT652 is accurate and complete, as it may impact their overall VAT liability or entitlement to VAT refunds.

How can I manage my vat652 form pdf directly from Gmail?

vat 652 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit vat652 form in Chrome?

Install the pdfFiller Google Chrome Extension to edit vat652 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit vat form 652 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as vat 652 form download. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your vat652 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

vat652 Form is not the form you're looking for?Search for another form here.

Keywords relevant to vat 652 form

Related to form 652

If you believe that this page should be taken down, please follow our DMCA take down process

here

.